[FX] USDJPY 구매 설정 / USDJPY BUY SETUP

FX개미

0

2360

2021.06.29 09:48

FX개미

0

2360

2021.06.29 09:48

U.S. Dollar / Japanese Yen

okako_trading

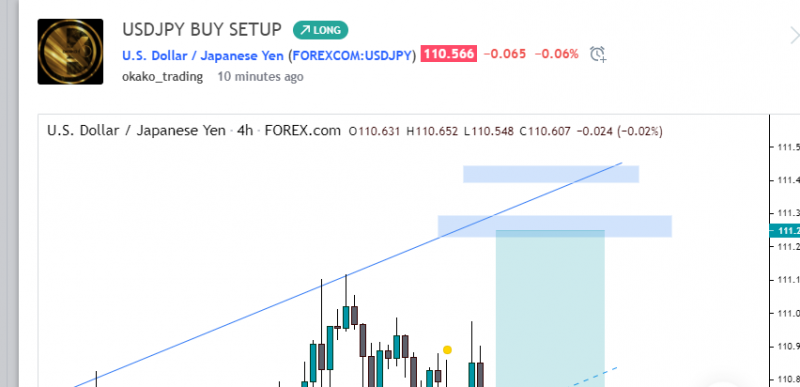

Entry : 110.620

⚠️ Stop Loss : 110.450

✅ Take profit : 111.250

Note :

Follow proper risk management rules. Never risk more than 2% of your total capital. Money management is the key 🗝 of success.

Using Risk Management will not only protect our capital, but will control and preserve our emotional well-being. Trade stress free!

For me, the Risk management has greater importance than the strategy. Whatever you are trading, you will keep blowing your account if you don’t use it properly. I have many people telling me they blew their accounts. If you risk 1% a trade, you have to lose 100 trades in a row to blow it. Is that even possible (because of market probability) lol!

If you are still trading with stress and keep blowing accounts, look at your risk. This business is all about risk so make sure to approach it correctly. It will also give you a sense of security and confidence.

Another important thing is that

Don't attach yourself to a trade. Accept the fact that price can change its direction at any time! Always use a Stop Loss and Breakeven management!

Anything is possible

Marrying trades is something that I haven’t struggled much with. When I take a loss, I just accept it. I used to depress myself and feel down, but never revenge trade and enter other positions.

If you are still struggling with that, it’s time to take action! This problem is easily fixed. You just have to accept that any trade can be a loss. Before entering a trade, you determine a level where your opinion will be invalid (basically your SL level). After that level is tagged, you are out! Accept it!

Another thing to learn is managing your position corretly. Taking partials along the way is important. The market can reverse at any given time and you can be 10% on profit and a moment later -2% loss. Introduce clear rules for breakeven and trade management!

What helped most is the book of Mark Douglas. He often says “anything can happen at any time”. Therefore, you have to be prepared at all times and you have to make sure to take your share from the market while it’s still there!

Finally, never revenge trade. As already said - if your Stop Loss is hit, just accept it and move on!

Disclaimer : We are not financial advisers , and this is not financial advice . Past Profits do not guarantee future results.

Good luck 🤞

⚠️ Stop Loss : 110.450

✅ Take profit : 111.250

Note :

Follow proper risk management rules. Never risk more than 2% of your total capital. Money management is the key 🗝 of success.

Using Risk Management will not only protect our capital, but will control and preserve our emotional well-being. Trade stress free!

For me, the Risk management has greater importance than the strategy. Whatever you are trading, you will keep blowing your account if you don’t use it properly. I have many people telling me they blew their accounts. If you risk 1% a trade, you have to lose 100 trades in a row to blow it. Is that even possible (because of market probability) lol!

If you are still trading with stress and keep blowing accounts, look at your risk. This business is all about risk so make sure to approach it correctly. It will also give you a sense of security and confidence.

Another important thing is that

Don't attach yourself to a trade. Accept the fact that price can change its direction at any time! Always use a Stop Loss and Breakeven management!

Anything is possible

Marrying trades is something that I haven’t struggled much with. When I take a loss, I just accept it. I used to depress myself and feel down, but never revenge trade and enter other positions.

If you are still struggling with that, it’s time to take action! This problem is easily fixed. You just have to accept that any trade can be a loss. Before entering a trade, you determine a level where your opinion will be invalid (basically your SL level). After that level is tagged, you are out! Accept it!

Another thing to learn is managing your position corretly. Taking partials along the way is important. The market can reverse at any given time and you can be 10% on profit and a moment later -2% loss. Introduce clear rules for breakeven and trade management!

What helped most is the book of Mark Douglas. He often says “anything can happen at any time”. Therefore, you have to be prepared at all times and you have to make sure to take your share from the market while it’s still there!

Finally, never revenge trade. As already said - if your Stop Loss is hit, just accept it and move on!

Disclaimer : We are not financial advisers , and this is not financial advice . Past Profits do not guarantee future results.

Good luck 🤞

번역:

미국 달러/일본 엔화

오카코의

입장 : 110.620

⚠ stop 정지손실 : 110.450

✅ 이익취득 : 111.250

참고:

적절한 위험 관리 규칙을 따르십시오. 총 자본의 2%를 초과하여 위험을 감수하지 마십시오. 자금 관리는 성공의 핵심 🗝입니다.

위험 관리를 사용하면 자본이 보호될 뿐만 아니라 정서적 복지를 통제하고 보존할 수 있습니다. 거래 스트레스 해소!

저는 리스크 관리가 전략보다 더 큰 중요성을 가지고 있습니다. 거래하는 것이 무엇이든 제대로 사용하지 않으면 계좌가 계속 끊어질 것이다. 나는 많은 사람들이 나에게 그들이 그들의 계좌를 망쳤다고 말한다. 1%의 거래를 위태롭게 한다면, 100개의 거래를 연속으로 잃어야 합니다. 그게 가능할까? (시장확률 때문에) lol!

만약 당신이 여전히 스트레스와 거래를 하고 있다면, 당신의 위험을 보세요. 이 사업은 리스크에 관한 것이므로 반드시 정확하게 접근해야 합니다. 그것은 또한 여러분에게 안정감과 자신감을 줄 것입니다.

또 다른 중요한 것은

거래를 하지 마라. 가격이 언제든지 방향을 바꿀 수 있다는 사실을 받아들이세요! 항상 손실 방지 및 균등한 관리 기능을 사용하십시오!

무엇이든 다 가능합니다.

장사와 결혼하는 것은 내가 별로 힘들어하지 않았던 것이다. 손해를 보면 그냥 받아들이죠. 나는 내 자신을 우울하게 하고 우울하게 느끼곤 했지만, 결코 무역에 복수하지 않고 다른 직책에 들어가지 않는다.

만약 여러분이 여전히 이 문제로 어려움을 겪고 있다면, 행동을 취해야 할 때입니다! 이 문제는 쉽게 고쳐진다. 당신은 어떤 거래든 손실이 될 수 있다는 것을 받아들여야만 합니다. 거래를 입력하기 전에 의견이 유효하지 않은 수준(기본적으로 SL 수준)을 결정합니다. 해당 레벨이 태그가 지정되면 로그아웃됩니다! 받아라!

또 하나 배워야 할 것은 자신의 위치를 정확하게 관리하는 것이다. 도중에 일부분을 복용하는 것은 중요하다. 시장은 언제든지 역전할 수 있으며, 당신은 10%의 이윤을 얻고 잠시 후 - 2%의 손실을 볼 수 있다. 손익분기점 및 무역관리의 명확한 규칙을 소개합니다!

가장 큰 도움이 된 것은 마크 더글러스의 책이다. 그는 종종 "무슨 일이든 언제든지 일어날 수 있다"고 말한다. 따라서, 여러분은 항상 준비가 되어 있어야 하고, 시장이 있는 동안 여러분의 몫을 가져가야 합니다!

마지막으로, 절대 무역에 복수하지 마세요. 이미 말한 대로 - Stop Loss(중지 손실)가 발생하면 그냥 수락하고 계속 진행하십시오!

부인: 우리는 재정 고문도 아니고, 이것은 재정 조언도 아닙니다. 과거의 이익은 미래의 결과를 보장하지 않습니다.

행운을 🤞

원문링크: https://www.tradingview.com/chart/USDJPY/3GBdqTrq-USDJPY-BUY-SETUP/

[본문뒤 추가문구] 서학개미 투자포럼 - 해외투자 트렌드의 중심