[코인] 리플(XRP) - 5월 31일 / Ripple (XRP) - May 31

코인개미

0

2574

2021.05.31 09:23

코인개미

0

2574

2021.05.31 09:23

XRP / U.S. Dollar

readCrypto

Hello?

Welcome, traders.

By "following", you can always get new information quickly.

Please also click "Like".

Have a good day.

-------------------------------------

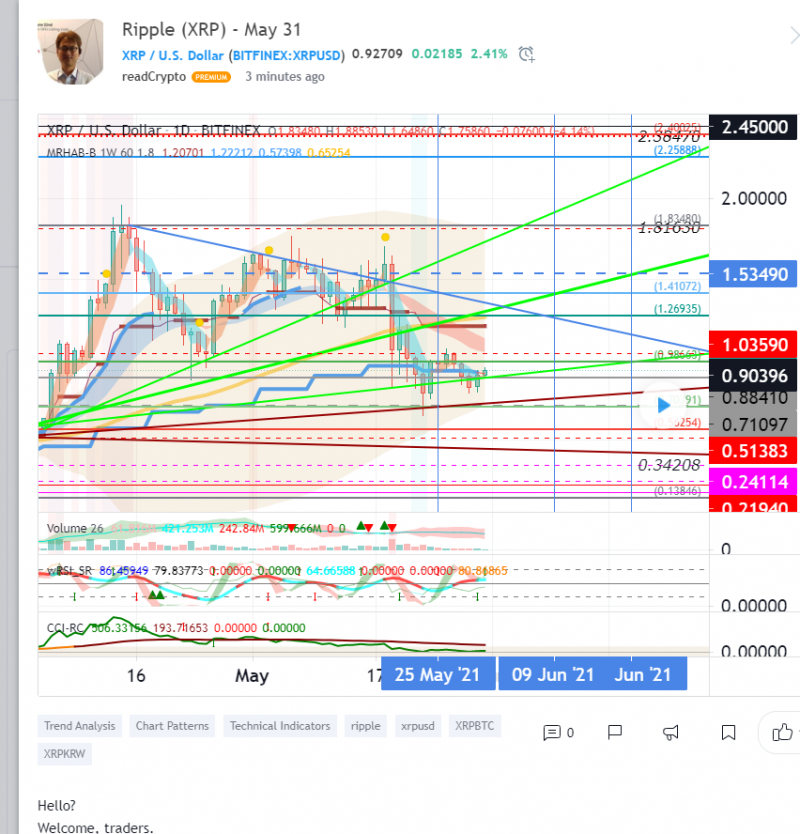

(XRPUSD 1W Chart)

(1D chart)

We need to see if we can move above the 1.03590 point along the uptrend line.

If it goes down, you should check to see if it finds support at the 0.71097-0.88410 range.

However, if it falls from the 0.88410 point, you need to trade cautiously.

It is important to break out of the downtrend line to turn into an uptrend.

As such, we should see if we can find support by moving up to the 1.26935-1.41072 section.

The 0.71097-0.88410 section is an important volume profile section.

-------------------------------------

( XRPBTC 1W chart)

(1D chart)

We will have to wait and see if we can go sideways on the 2466 Satoshi-2914 Satoshi section.

If it goes down, we should see if there is support in the 2316 satoshi-2466 satoshi section.

If it falls from the 2017 Satoshi point, Stop Loss is needed to preserve profit and loss.

However, you need to trade carefully as you can touch the 1569 Satoshi-1718 Satoshi section and climb along the upward trend line .

--------------------------------------

We recommend that you trade with your average unit price.

This is because, if the price is below your average unit price, whether it is in an uptrend or in a downtrend, there is a high possibility that you will not be able to get a big profit due to the psychological burden.

The center of all trading starts with the average unit price at which you start trading.

If you ignore this, you may be trading in the wrong direction.

Therefore, it is important to find a way to lower the average unit price and adjust the proportion of the investment, ultimately allowing the funds corresponding to the profits to regenerate themselves.

------------------------------------------------------------ -----------------------------------------------------

** All indicators are lagging indicators.

Therefore, it is important to be aware that the indicator moves accordingly with the movement of price and volume .

However, for the sake of convenience, we are talking in reverse for the interpretation of the indicator.

** The wRSI_SR indicator is an indicator created by adding settings and options to the existing Stochastic RSI indicator.

Therefore, the interpretation is the same as the traditional Stochastic RSI indicator. (K, D line -> R, S line)

** The OBV indicator was re-created by applying a formula to the DepthHouse Trading indicator, an indicator disclosed by oh92. (Thanks for this.)

** See support, resistance, and abbreviation points.

** Support or resistance is based on the closing price of the 1D chart.

** All descriptions are for reference only and do not guarantee a profit or loss in investment.

Explanation of abbreviations displayed in the chart

R: A point or section of resistance that requires a response to preserve profits.

S-L: Stop Loss point or section

S: A point or section where you can buy to make a profit as a support point or section.

(Short-term Stop Loss can be said to be a point where profit and loss can be preserved or additional entry can be made through split trading. It is a short-term investment perspective.)

GAP refers to the difference in prices that occurred when the stock market, CME , and BAKKT exchanges were closed because they are not traded 24 hours a day.

G1 : Closing price when closed

G2: Opening price

(Example) Gap (G1-G2)

Welcome, traders.

By "following", you can always get new information quickly.

Please also click "Like".

Have a good day.

-------------------------------------

(XRPUSD 1W Chart)

(1D chart)

We need to see if we can move above the 1.03590 point along the uptrend line.

If it goes down, you should check to see if it finds support at the 0.71097-0.88410 range.

However, if it falls from the 0.88410 point, you need to trade cautiously.

It is important to break out of the downtrend line to turn into an uptrend.

As such, we should see if we can find support by moving up to the 1.26935-1.41072 section.

The 0.71097-0.88410 section is an important volume profile section.

-------------------------------------

( XRPBTC 1W chart)

(1D chart)

We will have to wait and see if we can go sideways on the 2466 Satoshi-2914 Satoshi section.

If it goes down, we should see if there is support in the 2316 satoshi-2466 satoshi section.

If it falls from the 2017 Satoshi point, Stop Loss is needed to preserve profit and loss.

However, you need to trade carefully as you can touch the 1569 Satoshi-1718 Satoshi section and climb along the upward trend line .

--------------------------------------

We recommend that you trade with your average unit price.

This is because, if the price is below your average unit price, whether it is in an uptrend or in a downtrend, there is a high possibility that you will not be able to get a big profit due to the psychological burden.

The center of all trading starts with the average unit price at which you start trading.

If you ignore this, you may be trading in the wrong direction.

Therefore, it is important to find a way to lower the average unit price and adjust the proportion of the investment, ultimately allowing the funds corresponding to the profits to regenerate themselves.

------------------------------------------------------------ -----------------------------------------------------

** All indicators are lagging indicators.

Therefore, it is important to be aware that the indicator moves accordingly with the movement of price and volume .

However, for the sake of convenience, we are talking in reverse for the interpretation of the indicator.

** The wRSI_SR indicator is an indicator created by adding settings and options to the existing Stochastic RSI indicator.

Therefore, the interpretation is the same as the traditional Stochastic RSI indicator. (K, D line -> R, S line)

** The OBV indicator was re-created by applying a formula to the DepthHouse Trading indicator, an indicator disclosed by oh92. (Thanks for this.)

** See support, resistance, and abbreviation points.

** Support or resistance is based on the closing price of the 1D chart.

** All descriptions are for reference only and do not guarantee a profit or loss in investment.

Explanation of abbreviations displayed in the chart

R: A point or section of resistance that requires a response to preserve profits.

S-L: Stop Loss point or section

S: A point or section where you can buy to make a profit as a support point or section.

(Short-term Stop Loss can be said to be a point where profit and loss can be preserved or additional entry can be made through split trading. It is a short-term investment perspective.)

GAP refers to the difference in prices that occurred when the stock market, CME , and BAKKT exchanges were closed because they are not traded 24 hours a day.

G1 : Closing price when closed

G2: Opening price

(Example) Gap (G1-G2)

번역:

XRP/미국 달러

크립토를 읽다

여보세요?

어서오세요, 상인 여러분.

"팔로우"를 통해 항상 새로운 정보를 빠르게 얻을 수 있습니다.

또한 "좋아요"를 누르십시오.

좋은 하루 되세요.

-------------------------------------

(XRPUSD 1W 차트)

(1D 관리도)

우리는 1.03590 포인트 이상에서 상승 추세선을 따라 움직일 수 있는지 알아봐야 합니다.

이 값이 내려가면 0.71097-0.88410 범위에서 지원이 검색되는지 확인해야 합니다.

다만 0.88410포인트에서 떨어지면 신중하게 거래해야 한다.

상승세로 전환하기 위해서는 하락장에서 벗어나는 것이 중요하다.

따라서 1.26935~1.41072 구간으로 이동하여 지원을 받을 수 있는지 확인해야 합니다.

0.71097-0.88410 섹션은 중요한 볼륨 프로파일 섹션입니다.

-------------------------------------

(XRPBTC 1W 차트)

(1D 관리도)

2466 사토시-2914 사토시 구간에서 옆으로 갈 수 있는지 지켜봐야 할 것 같습니다.

내려가면 2316 사토시-2466 사토시 구간에 지원이 있는지 살펴봐야 한다.

2017년 사토시 포인트에서 하락할 경우 손익보전을 위해 스톱 로스가 필요하다.

다만 1569 사토시-1718 사토시 구간을 터치하고 상승 추세선을 따라 오를 수 있어 신중하게 거래할 필요가 있다.

--------------------------------------

우리는 당신이 당신의 평균 단가로 거래하는 것을 추천합니다.

상승세든 하강세든 가격이 평균 단가를 밑돌면 심리적 부담으로 큰 수익을 얻지 못할 가능성이 크기 때문이다.

모든 거래의 중심은 거래를 시작하는 평균 단가로 시작됩니다.

이를 무시하면 잘못된 방향으로 거래될 수 있습니다.

따라서 평균 단가를 낮추고 투자 비중을 조절해 궁극적으로는 이익에 상응하는 자금이 스스로 재생되도록 하는 방안을 찾는 것이 중요하다.

------------------------------------------------------------ -----------------------------------------------------

** 모든 표시기는 후행 표시기입니다.

따라서 가격과 물량의 움직임에 따라 지표가 적절히 움직인다는 점을 유념하는 것이 중요하다.

다만 편의를 위해 지표 해석을 위해 역방향 대화를 하고 있다.

** wRSI_SR 표시기는 기존 확률 RSI 표시기에 설정과 옵션을 추가하여 생성된 표시기입니다.

따라서 해석은 기존의 확률적 RSI 지표와 동일하다. (K, D선 -> R, S선)

** OBV 지표는 oh92가 공시한 지표인 Depth House Trade 지표에 공식을 적용하여 재작성하였습니다. (감사합니다.)

** 지원, 저항 및 약어 항목을 참조하십시오.

** 지원 또는 저항은 1D 차트의 마감 가격을 기준으로 합니다.

** 모든 설명은 참고용이며 투자손익은 보장하지 않습니다.

차트에 표시되는 약어에 대한 설명

R: 이익을 보존하기 위해 대응이 필요한 저항 지점 또는 섹션.

S-L: 정지 손실 지점 또는 섹션

S: 포인트 또는 섹션으로 수익을 내기 위해 구입할 수 있는 포인트 또는 섹션.

(단기 정지손실은 손익을 보전하거나 분할거래를 통해 추가 진입이 가능한 지점이라고 할 수 있다. 단기 투자 관점입니다.)

GAP은 24시간 거래가 되지 않아 주식시장, CME, BAKT 거래소가 문을 닫으면서 발생한 가격 차이를 말한다.

G1 : 마감시 종가

G2: 개점가격

(예) 갭(G1-G2)

원문링크: https://www.tradingview.com/chart/XRPUSD/wnoxMGE9-Ripple-XRP-May-31/

[본문뒤 추가문구] 서학개미 투자포럼 - 해외투자 트렌드의 중심