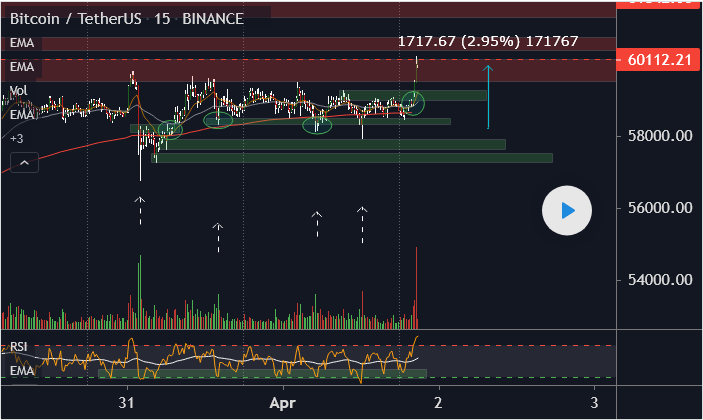

[코인] BTCUSDT 01 APR 2021 (지원/수요 누적) / BTCUSDT 01 APR 2021 (accumulatio…

코인개미

0

2460

2021.04.02 12:11

코인개미

0

2460

2021.04.02 12:11

Bitcoin / TetherUS

dee718

I have the volume bar colors inverted so that green represents buying and red represents selling. This is not always teh case and you must still use techinal judgment.... But its easy when you think about it. Buy low and sell high.

Some vocab that is no secret. Its just terminology out of the VSA method world (wyckoff). Trying to get a handle on the price action/no indicator methods in combination with VSA ...very high probability targeting.

Stopping volume

Climatic volume

No supply

No demand

Previous support turned resistance

previous resistance turned support

Previous supply block

previous demand block

Sources of education:

Richard Wyckoff

Tom Williams Volume spread analysis VSA / Master the Markets

Pete Faders VSA*

Read the ticker dot com

Wyckoff analytics

Dee Nixon

Avoid buying into weakness/supply/resistance

Avoid selling into strength/demand/support

Avoid entry when price is in middle of a range (phase B)

When you set a target and wait for price to get there (proactive/decreased risk)

When you enter a trade when its already on its way to a target (reactive/increased risk)

Some vocab that is no secret. Its just terminology out of the VSA method world (wyckoff). Trying to get a handle on the price action/no indicator methods in combination with VSA ...very high probability targeting.

Stopping volume

Climatic volume

No supply

No demand

Previous support turned resistance

previous resistance turned support

Previous supply block

previous demand block

Sources of education:

Richard Wyckoff

Tom Williams Volume spread analysis VSA / Master the Markets

Pete Faders VSA*

Read the ticker dot com

Wyckoff analytics

Dee Nixon

Avoid buying into weakness/supply/resistance

Avoid selling into strength/demand/support

Avoid entry when price is in middle of a range (phase B)

When you set a target and wait for price to get there (proactive/decreased risk)

When you enter a trade when its already on its way to a target (reactive/increased risk)

번역:

비트코인/테더미국

디718

볼륨 바 색상이 반전되어 녹색은 구매를 나타내고 빨간색은 판매를 나타냅니다. 이건 항상 그런 건 아니니까 기술적 판단을 해야 해... 하지만 그것에 대해 생각할 때 그것은 쉬워요. 싸게 사서 비싸게 팔다

비밀도 아닌 어떤 어휘. VSA 메서드 월드를 벗어나는 용어일 뿐입니다(Wickoff). VSA와 함께 가격 조치/표시 안 함 방법을 처리하려고 하는 중... 매우 높은 확률 목표 설정.

정지볼륨

기후량

공급 없음

수요 없음

이전 지원에서 저항을 반환됨

이전 저항 회전 지원

이전 공급 블록

이전의 수요 블록

교육 출처:

리처드 와이코프

Tom Williams 볼륨 분산 분석 VSA/Master the Markets

Pete Faders VSA*

눈금자 도트 컴을 읽습니다.

Wyckoff 분석

디 닉슨

약점/공급/저항을 구매하지 마십시오.

강세/수요/지지력 판매 방지

가격이 범위(B단계)의 중간에 있을 때는 진입을 피하십시오.

목표를 설정하고 가격이 달성될 때까지 기다릴 때(사전 예방적/위험 감소)

이미 목표값에 도달하고 있는 거래(리액티브/리스크 증가)를 입력할 때

원문링크: https://www.tradingview.com/chart/BTCUSDT/PqDL9Bjm-BTCUSDT-01-APR-2021-accumulation-of-support-demand/

서학개미 투자포럼 - 해외투자 트렌드의 중심